If you want to buy a home, you should know your credit score is a critical piece of the puzzle when it comes to qualifying for a mortgage. Lenders review your credit to see if you typically make payments on time, pay back debts, and more. Your credit score can also help determine your mortgage rate. An article from US Bank explains:

“A credit score isn’t the only deciding factor on your mortgage application, but it’s a significant one. So, when you’re house shopping, it’s important to know where your credit stands and how to use it to get the best mortgage rate possible.”

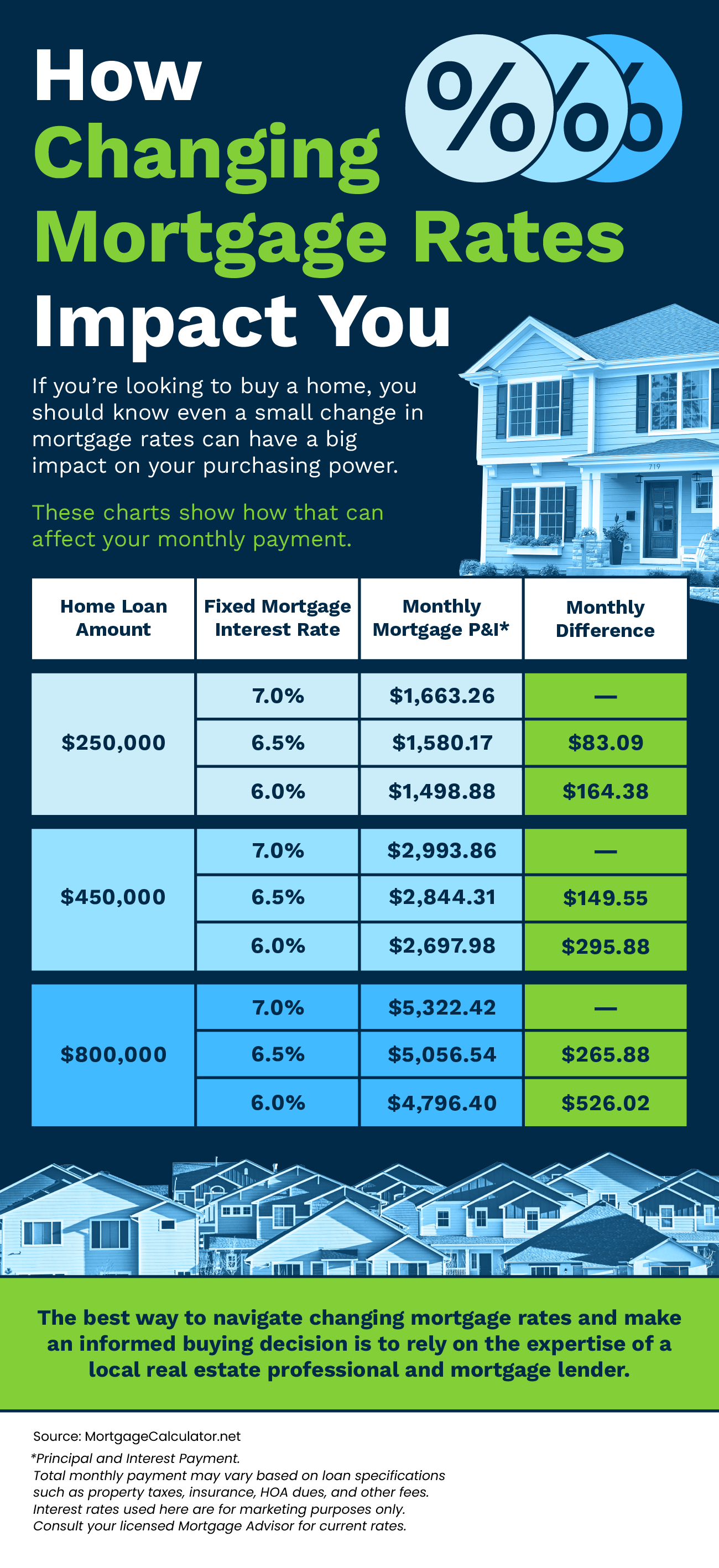

That means your credit score may feel even more important to your homebuying plans right now since mortgage rates are a key factor in affordability. According to the Federal Reserve Bank of New York, the median credit score in the U.S. for those taking out a mortgage is 770. But that doesn’t mean your credit score has to be perfect. The same article from US Bank explains:

“Your credit score (commonly called a FICO Score) can range from 300 at the low end to 850 at the high end. A score of 740 or above is generally considered very good, but you don’t need that score or above to buy a home.”

Working with a trusted lender is the best way to get more information on how your credit score could factor into your home loan and the mortgage rate you’re able to get. As FICO says:

“While many lenders use credit scores like FICO Scores to help them make lending decisions, each lender has its own strategy, including the level of risk it finds acceptable. There is no single “cutoff score” used by all lenders and there are many additional factors that lenders may use to determine your actual interest rates.”

If you’re looking for ways to improve your score, Experian highlights some things you may want to focus on:

- Your Payment History: Late payments can have a negative impact by dropping your score. Focus on making payments on time and paying any existing late charges quickly.

- Your Debt Amount (relative to your credit limits): When it comes to your available credit amount, the less you’re using, the better. Focus on keeping this number as low as possible.

- Credit Applications: If you’re looking to buy something, don’t apply for additional credit. When you apply for new credit, it could result in a hard inquiry on your credit that drops your score.

Finding ways to make your credit score better could help you get a lower mortgage rate. If you want to learn more, I can provide recommendations for trusted lenders.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link