Here’s a transcript of Jeff Tucker’s most recent video, taking a local look at the February 2025 date from the Northwest MLS.

The Northwest MLS the headline this month is that sales activity slowed down in February after a strong January and an especially strong Q4 of 2024.

We saw both buyer activity and listing activity slow down a bit relative to last year.

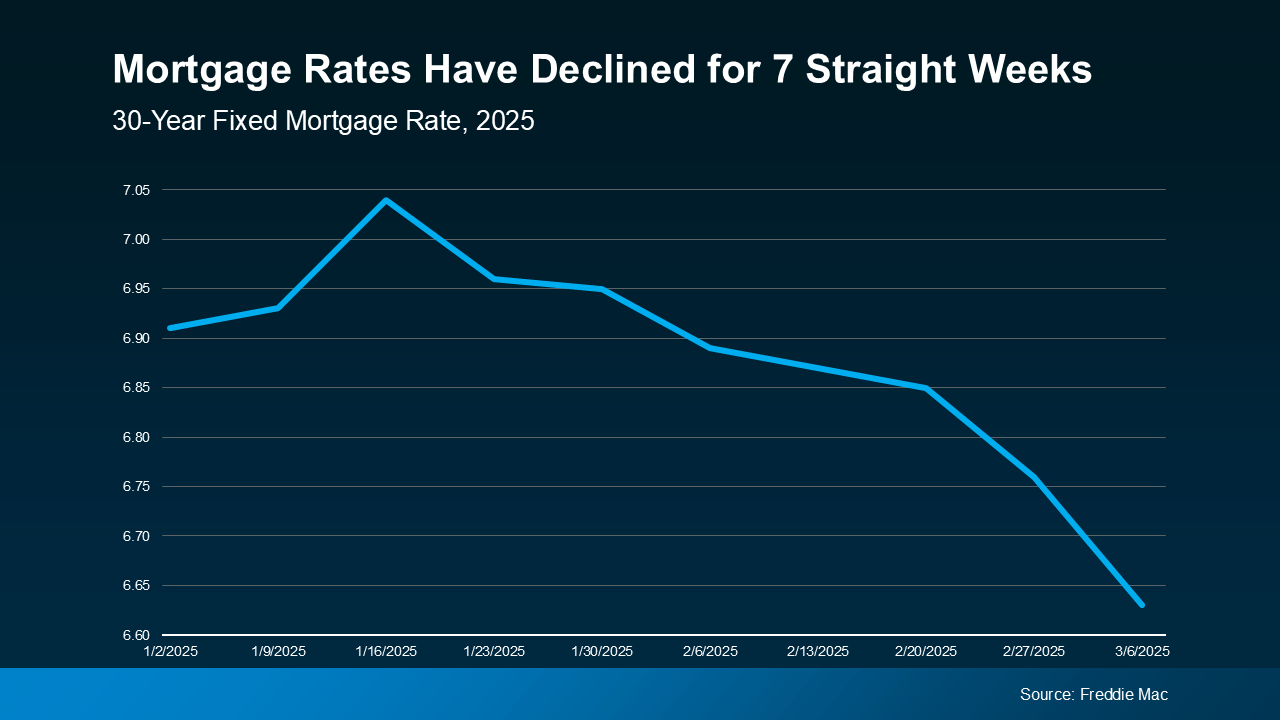

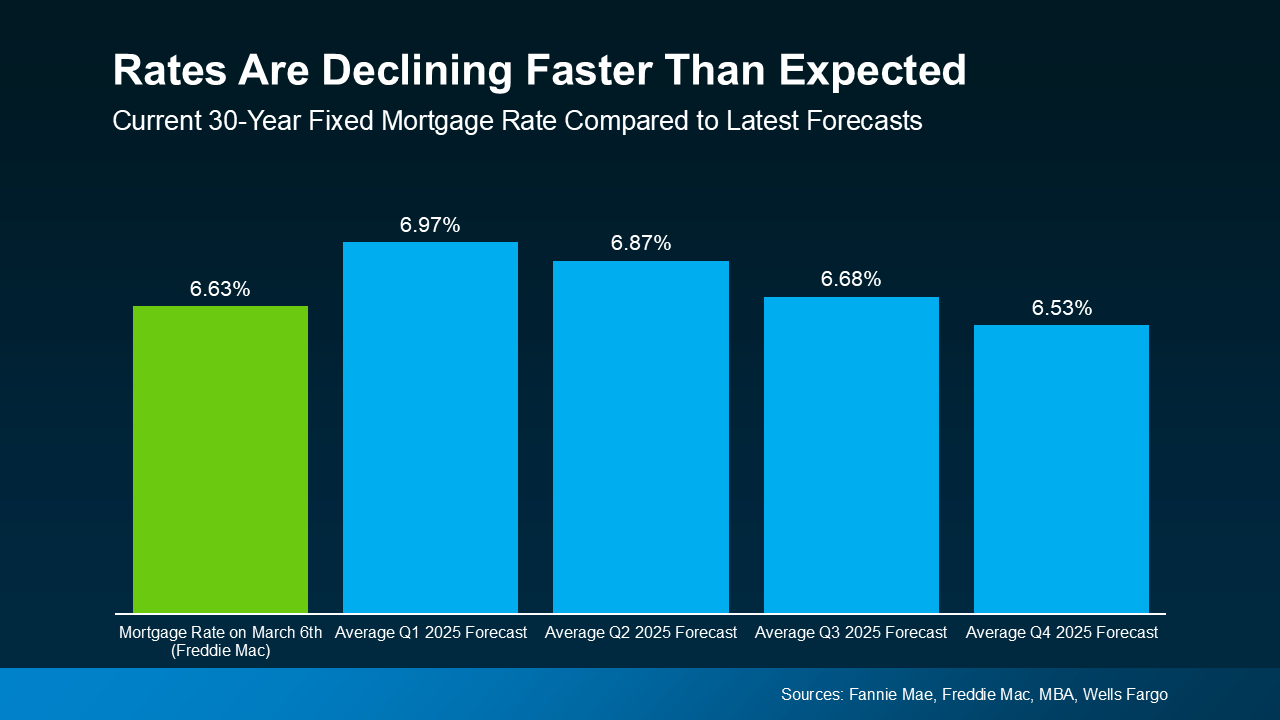

I think the rise in mortgage rates back to around 7% this winter has finally cooled off some of the buyer enthusiasm we saw in Q4.

Here are the four key metrics I watched to track supply and demand in the market:

Closed and pending sales, which tell us a lot about demand.

Listings, both new and active, which tell us a lot about supply.

Across the Northwest MLS, closed sales of single family homes were almost exactly flat year-over-year at 3,550 versus last year’s 3,553.

Pending sales, which will mostly close in March, dropped 4% from the same month last year. One extending circumstance we had was one less business day this February, since last year was a leap year, but this is still looking like a cooler market in terms of demand than we’ve seen in a few months.

On the supply side, about 5% fewer new listings hit the market this February compared to last year’s, but the pool of active listings ended the month 33% higher than February 2024’s inventory.

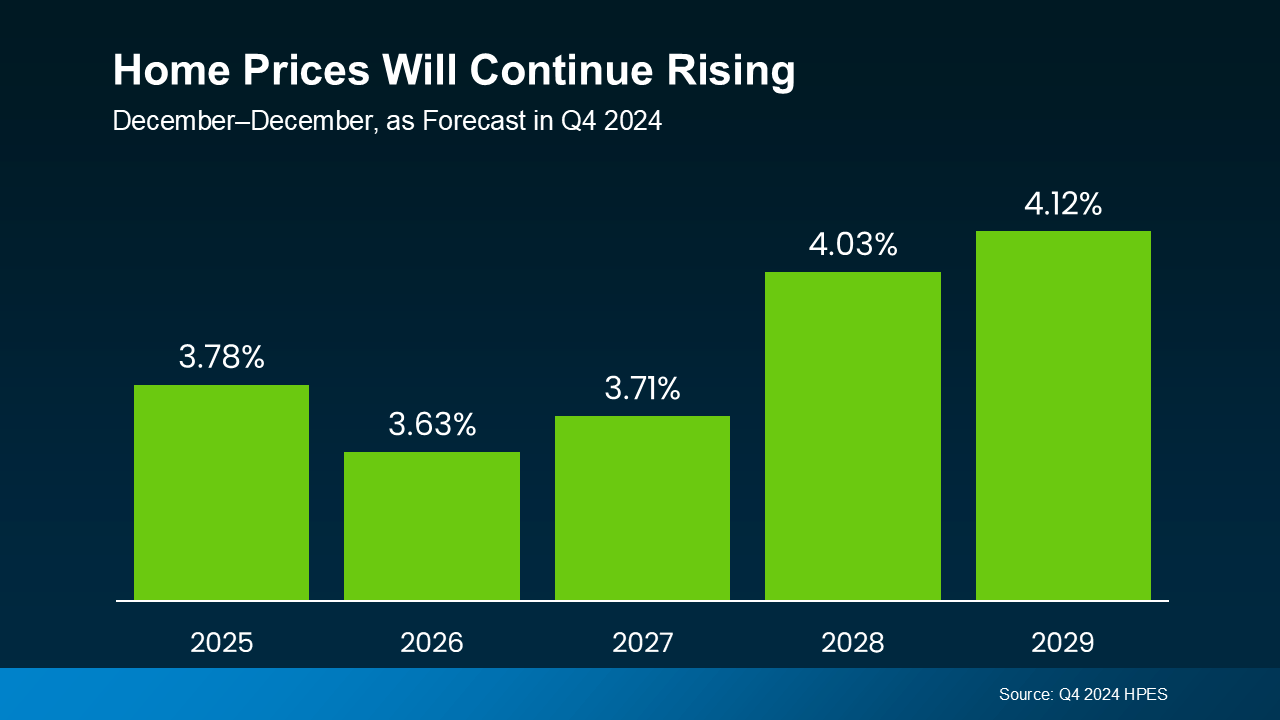

The final key metric to check in on across the Northwest MLS is the median price for those closed single family home sales, which climbed just 2% year-over-year in February from about 635,000 to $650,000.

That also represents a cooldown from the median price growth that we’ve been seeing in Q4, and it seems to indicate that the higher levels of inventory and more modest demand in the market are putting some competitive pressure on sellers, preventing prices from rising too much

Overall Cooldown

Putting it all together, this looks like a market where the normal seasonal upswing in sales and prices has begun, but the year-over-year comparisons are looking a lot cooler than they were throughout Q4 and even in January.

I think that cool down was mostly due to interest rates rebounding this winter, but looking ahead if we see the recent dip in interest rates in late February and early March actually stick, I could see some of that heat coming back into the market right as we hit the spring selling season.

Residential Closed Sales

Now I’ll dig into the four counties encompassing the greater Seattle area where a similar cool down played out in February.

- Residential closed sales were flat year-over-year here in King County.

- They inched up 1% across the sound in Kitsap County.

- The dipped 2% in Pierce County, including Tacoma.

- The fell 3% in Snohomish County, which includes Everett.

For these four counties altogether, that’s a dip of 1% from the same month last year. Not bad, but it is a slow down after 6% growth in January.

Median Price

The median sale price was mostly flat locally.

- 0% change from last year in King County and Snohomish County.

- Up 4% in Kitsap

- Up 5% in Pierce County

Pending Sales

Looking ahead pending sales were flat or down locally, but mostly down.

- Down 4% in King County

- Down 16% in Kitsap

- Flat in Pierce County

- Down 10% in Snohomish County

Altogether that makes a 6% decline across the four counties in pending sales, suggesting that we will see fewer closings in March compared to March of last year.

Supply

On the supply side, the four county Greater Seattle area had about 35% more active listings at the end of February than the same time last year.

That inventory growth came in spite of a 7% decline across the region in the flow of new listings this February.

Again, that was potentially impacted by the slightly shorter month, but it does suggest sellers haven’t been flocking to list their homes in greater numbers yet this year.

It could also be due to sellers jumping the gun on listing, so year to date new listings are

actually up 8% thanks to some very impressive new listing growth in January.

Now I’ll be curious to see if the recent dip in mortgage rates can help restart the listing pipeline locally after a pretty modest February.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

Where the Market Stands Now

Where the Market Stands Now Do you know how to adjust your plans based on who’s got the most negotiating power? Because an agent does.

Do you know how to adjust your plans based on who’s got the most negotiating power? Because an agent does.

What Are My Staging Options?

What Are My Staging Options?