Are you thinking about buying a home, but not sure if now’s the right time? A lot of people are waiting and wondering what the market’s going to do next. But here’s something only the savviest buyers realize:

This summer might actually be the best time to buy in years. Here are three big reasons why.

1. You Have More Negotiating Power

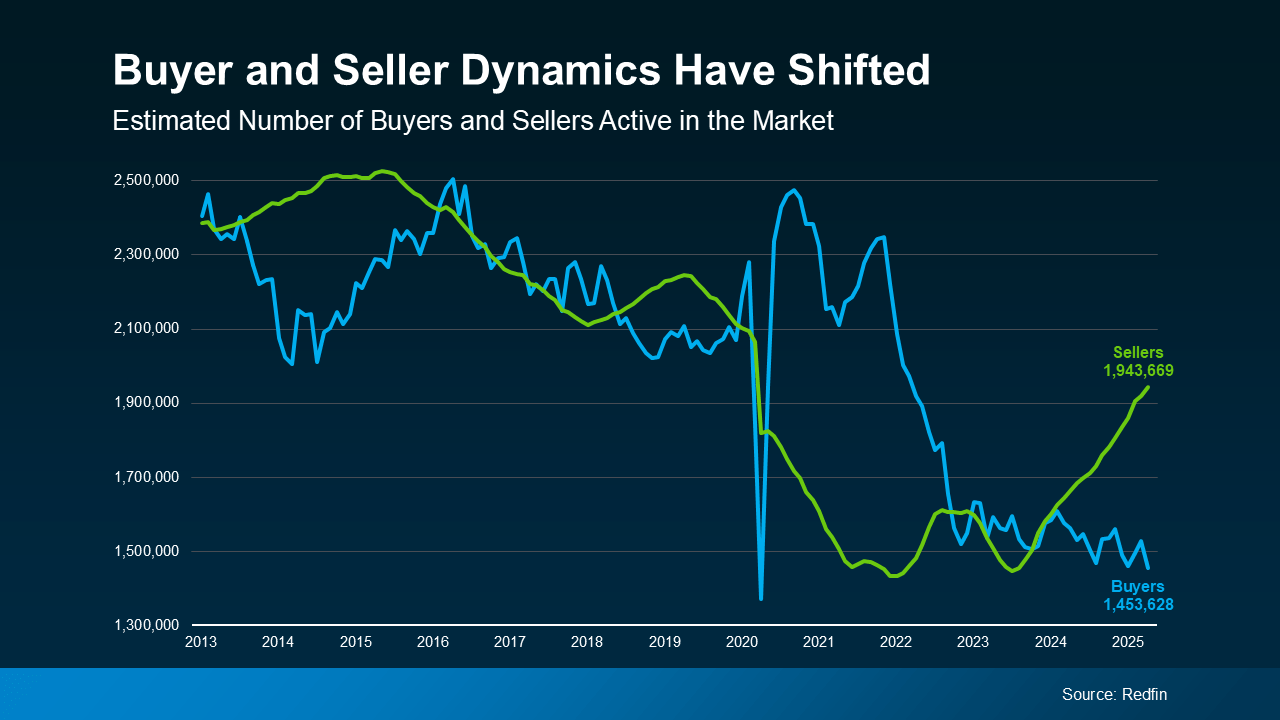

After several years of sellers having all the leverage, things are starting to shift. Check out the graph below. It uses data from Redfin to show that right now, there are more sellers active in the market than buyers:

Take a look at what happened back in 2021 through roughly 2023. In that time period, there were far more buyers (the blue line) looking to buy than homes for sale (the green line). That’s what drove the intense competition, bidding wars, and the exponential price growth the market saw back then.

Take a look at what happened back in 2021 through roughly 2023. In that time period, there were far more buyers (the blue line) looking to buy than homes for sale (the green line). That’s what drove the intense competition, bidding wars, and the exponential price growth the market saw back then.

Now, the market has shifted, and buyers are regaining their negotiating power as a result. With more sellers than buyers, sellers may be more willing to pay for repairs, cover some of your closing costs, or lower their asking price. The return of this kind of normal balance is a sign of a much healthier, more sustainable market. As Lawrence Yun, Chief Economist of the National Association of Realtors (NAR), explains:

“ . . . with housing inventory levels reaching five-year highs, homebuyers in nearly every region of the country are in a better position to negotiate more favorable terms.”

And just in case you’re worried there are too many homes on the market, here’s what you should know. Overall inventory is still lower than normal, so you don’t have to worry about a nationwide oversupply or a crash.

2. You Have More Choices

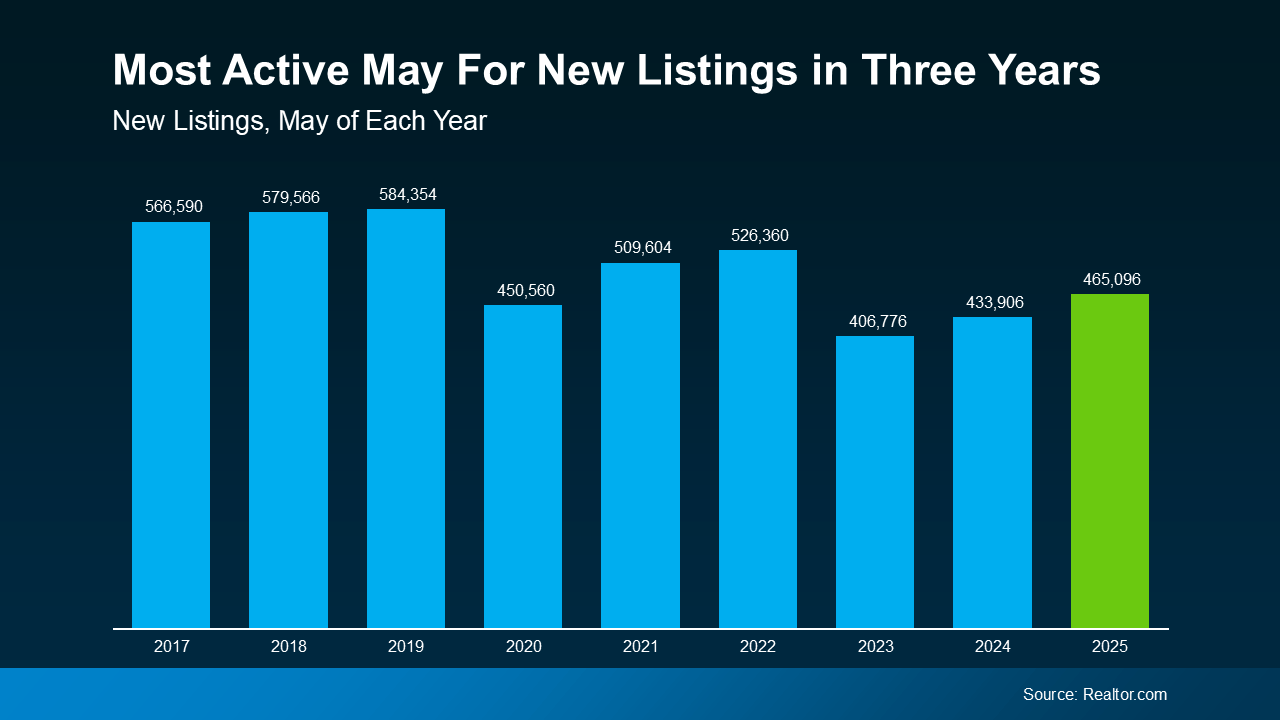

The number of homes for sale has improved a lot. Based on the latest data from Realtor.com, more homes were listed this May than in May 2024 or May 2023 (see graph below):

And more homes for sale means more choices. There’s a good chance your perfect match just hit the market – or it will soon. So, it’s a great time to explore what’s out there. As Jake Krimmel, Economist at Realtor.com, says:

And more homes for sale means more choices. There’s a good chance your perfect match just hit the market – or it will soon. So, it’s a great time to explore what’s out there. As Jake Krimmel, Economist at Realtor.com, says:

“With more fresh inventory hitting the market, buyers have better opportunities to find a home that fits their needs.”

3. You May See More Flexibility on Price

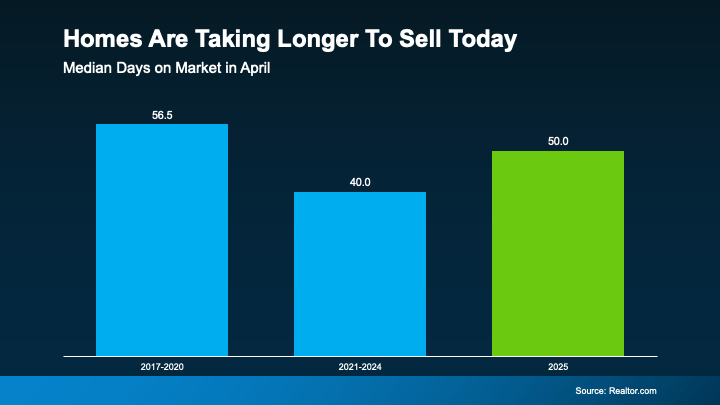

With more homes for sale, they’re not selling at the same frenzied pace they were just a few years ago.

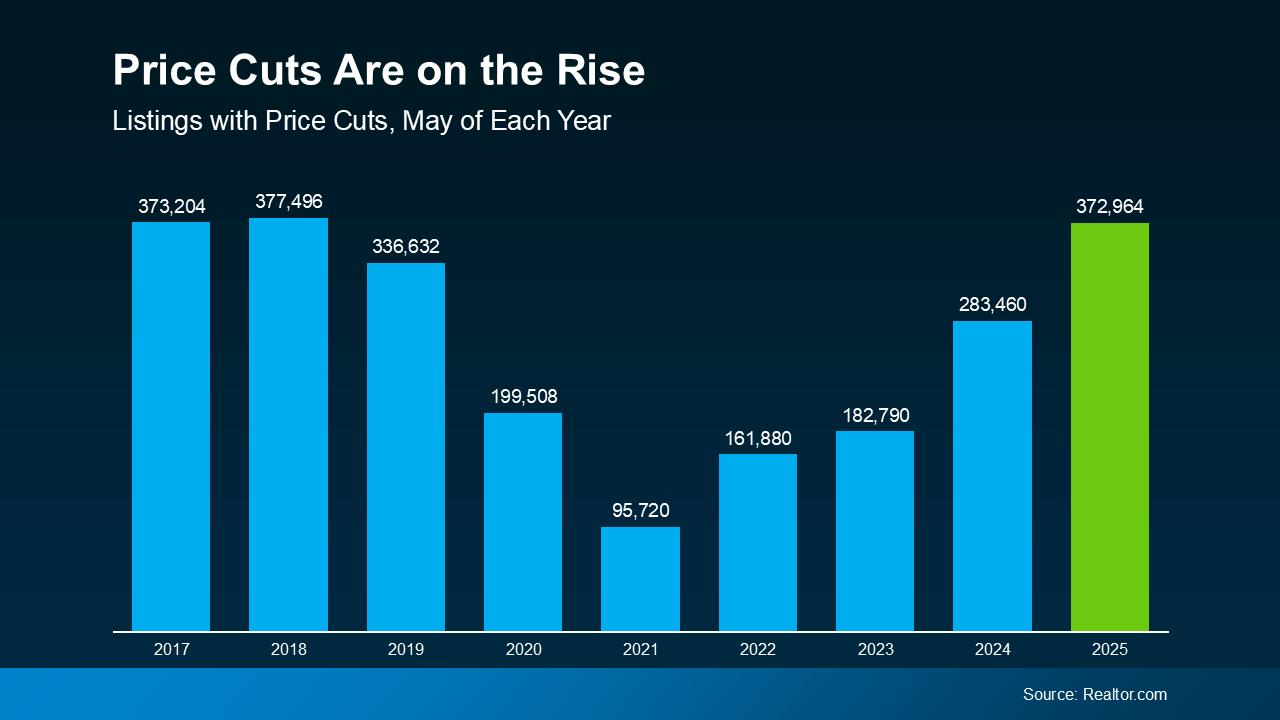

Since homes are taking more time to sell, some sellers are choosing to lower their asking prices to draw buyers back in or speed up the process. And that’s to-be-expected. According to Realtor.com, 19.1% of listings had a price cut this May (see graph below):

That’s the fifth straight month where more sellers have reduced their price. And, as of May, the volume of price cuts is back at normal levels. This is yet another sign of the return to a more balanced market.

That’s the fifth straight month where more sellers have reduced their price. And, as of May, the volume of price cuts is back at normal levels. This is yet another sign of the return to a more balanced market.

While you shouldn’t expect a big discount, you may find sellers are a bit more flexible right now. As a recent article from The Street says:

“Although sellers have had the upper hand in the housing market over the past few years, houses are now staying on the market for longer, shifting negotiating power back to homebuyers.”

Just remember, most sellers still aren’t adjusting their prices – just the ones who overpriced to start with. So, this isn’t a sign of a crash, it’s a sign of some sellers having outdated expectations in a shifting market.

So, this summer brings a powerful combo for buyers: more homes to choose from, less competition, and sellers being more flexible on pricing. If you’re ready to make a move, let’s connect.

What would finding the right home this summer mean for your next chapter?

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

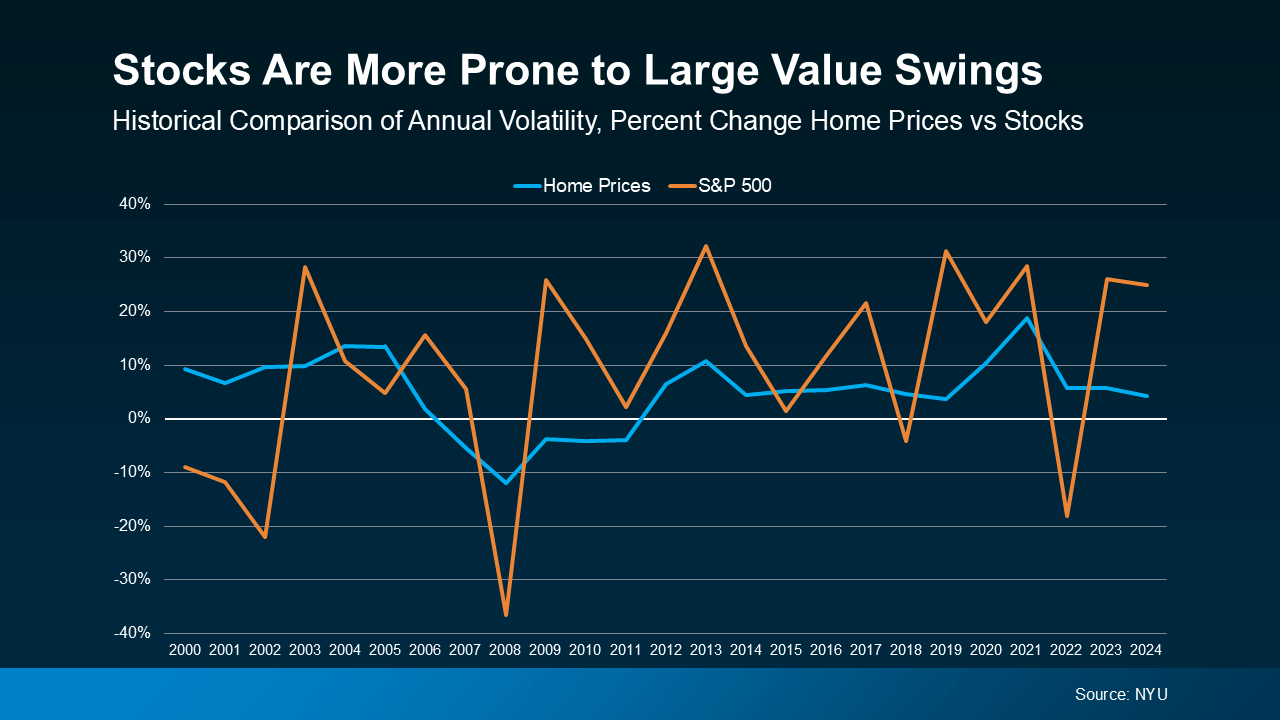

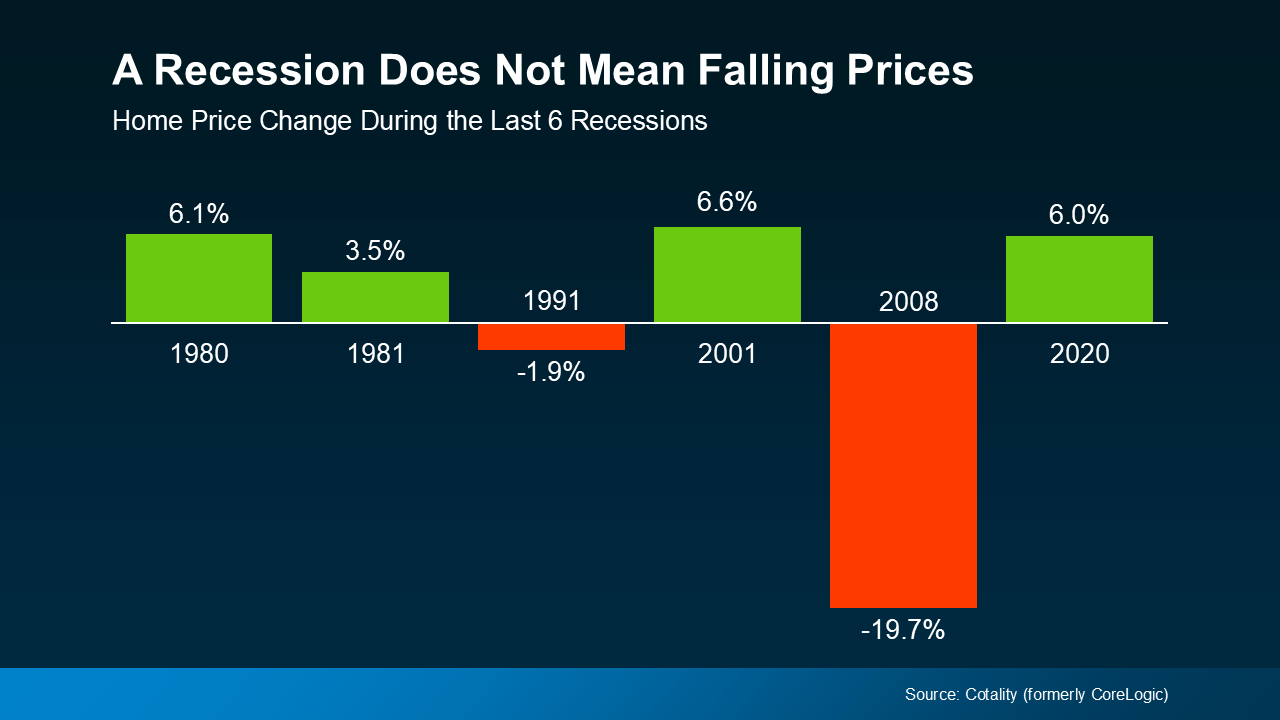

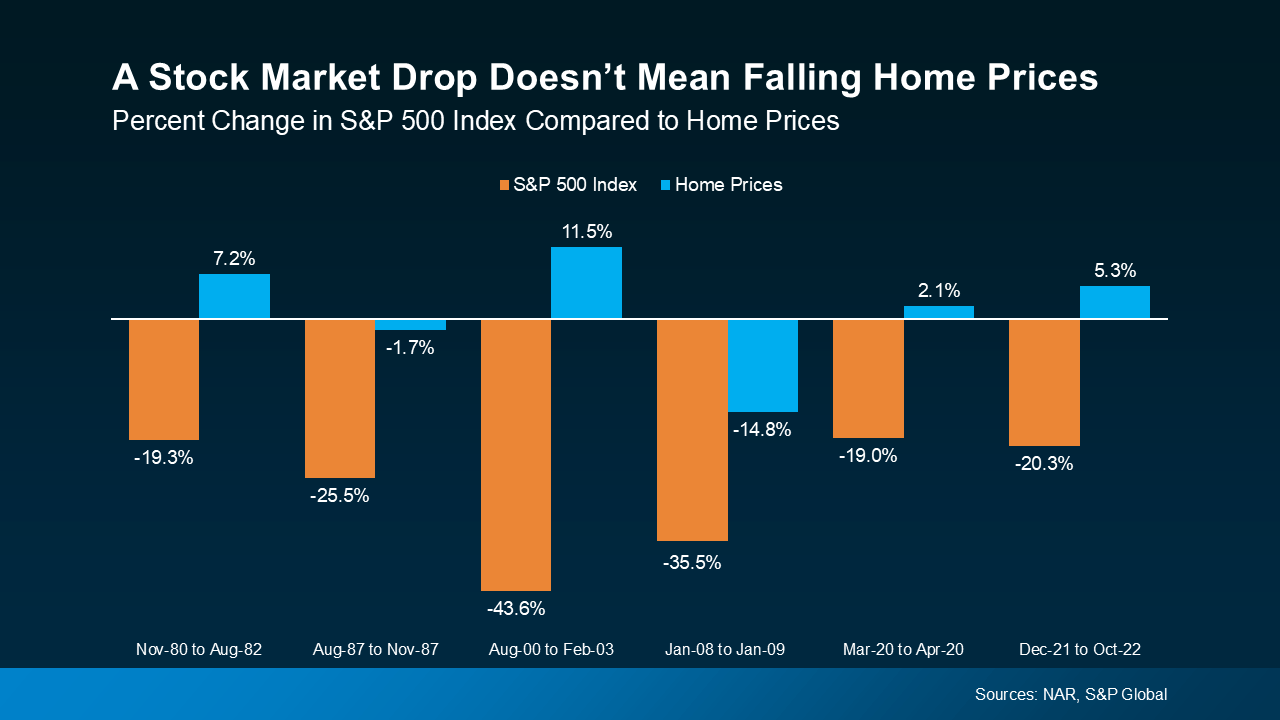

Even when the stock market falls more substantially, home prices don’t always come down with it.

Even when the stock market falls more substantially, home prices don’t always come down with it.